The following is a description of what functions can be found in the Accountings tab and what they can be used for.

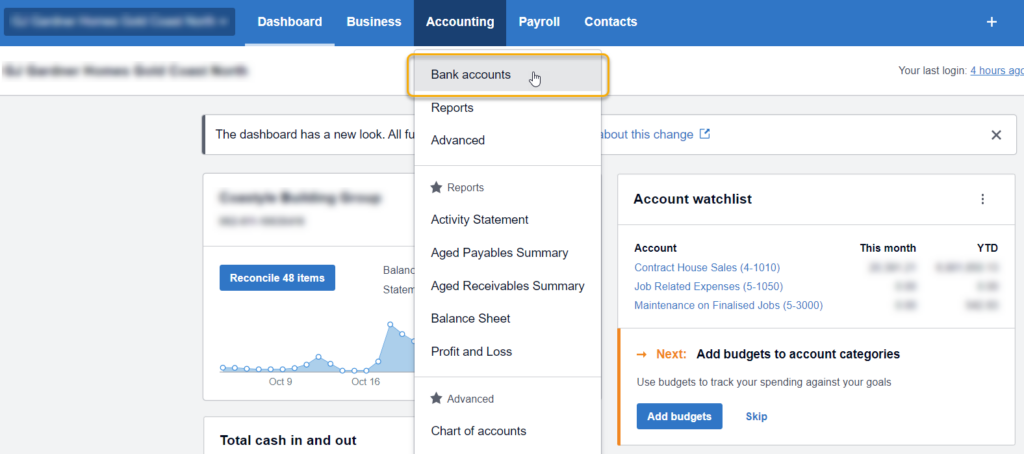

Bank Accounts

This domain contains the list of the business bank accounts. From here you can manage and see an overall view of each account, as well as transfer monies, perform bank reconciliations and view statements.

To see a list of transactions for a certain account, simply click on the account you wish to view.

Insert link here to related article.

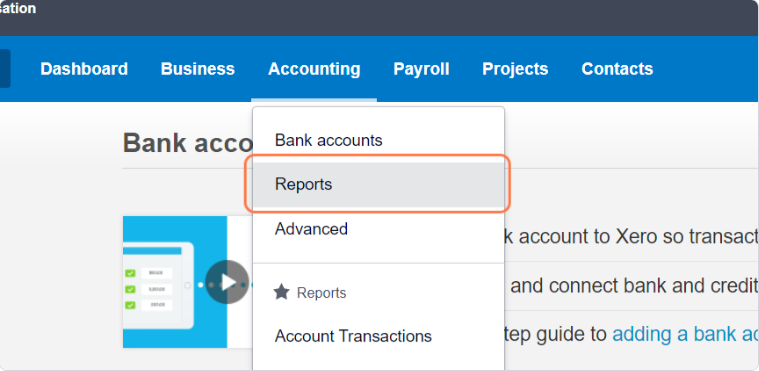

Reports Domain

Xero has a range of reports in addition to those available in the G.J Software.

All the reports are grouped into 7 Categories.

- Financial performance

- Financial statements

- Payables and Receivables

- Payroll

- Reconciliations

- Tax and balances

- Transaction

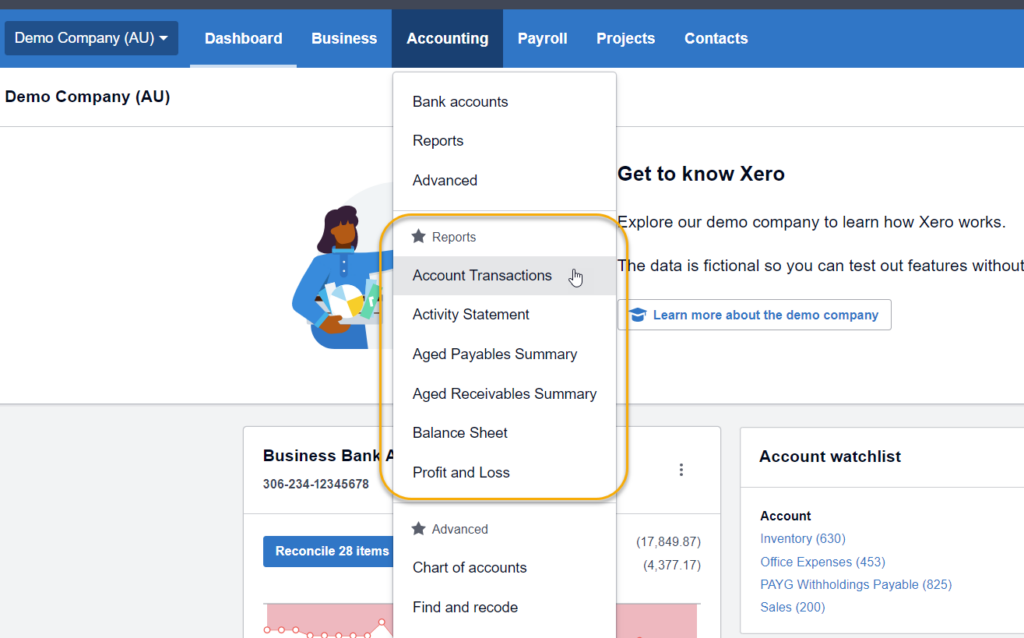

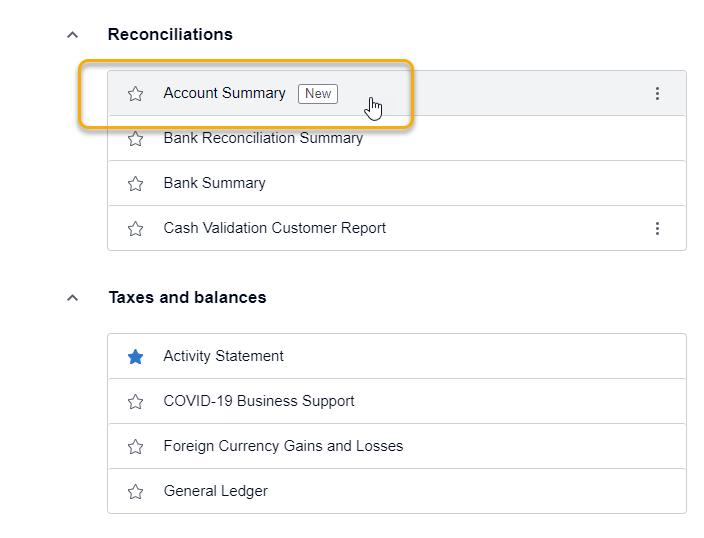

Above all these categories at the top of the page is a favourites section.You can also select reports as favourites so they stay as a shortcut under the accounting tab drop down menu for quick access, just click on the star beside the report you want to keep as a favourite.

You will see some of the reports within these categories are marked as new which are added or updated versions by Xero.

These reports usually have more flexibility around filter and field options. Experiment to find the exact report you want or you can export as a PDF, to Excel or Google Sheets where you can manipulate the data further.

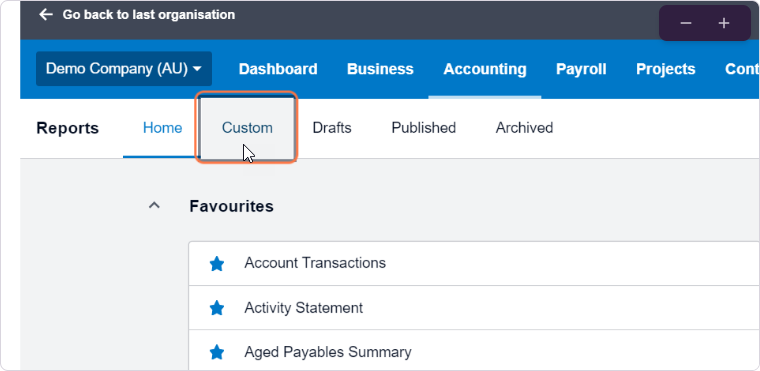

Reports also have an area where they are created or stored.

Once you have published a report it will stay under published reports. Reports can be moved to Archived if not required.

For further information on developing the report you want aside from those listed as standard, please visit custom report layouts

Will have to add links to different reports and their functions,

Advanced Accounting domain

This area of Xero is only accessible with the correct user permissions. Please talk to your franchisee if you need access and don’t have it.

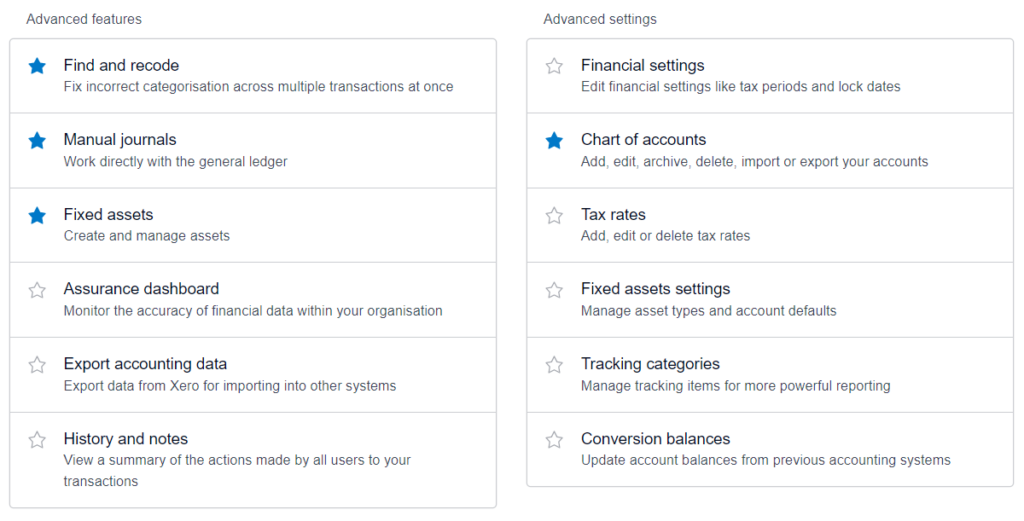

Here, you will find a list of advanced settings and advanced features.

In advanced features are the following;

Manual Journals

Users of this function should have a good understanding of the principles of double entry accounting. Manual Journals allows you to move amounts between General Ledger accounts (aside from bank accounts).

In advanced settings are the following;

Financial Settings – Locked Dates

Click here to see a related article about Locking dates in Xero. Add link.

Financial Settings – GST Calculation Setup

GST setup is dictated by Financial Settings choices made and obligations to the Australian Tax Office. This should be done by your Accountant or bookkeeper and any changes discussed with them. Once this section is completed, you can choose to run your business activity statement (BAS) from the reports menu.

As with all statutory reporting please work with your Accountant & Bookkeeper.

Chart of Accounts

This area allows you to view and maintain your Chart of Accounts. The accounts are presented on tabs, with a tab for each of the standard accounting categories.

These accounts should not be added or amended in most circumstances and to work with your Accountant and Bookkeeper in regards to these.

Any accounts that affect the Profit and Loss should not be changed without contacting your head office.

For more information on the Chart of Accounts function, please click the following link.

Add link for related article.