A credit note (Adjustment) is used when a supplier has to reduce a cost previously charged. The credit note is used to reduce the amount outstanding to the supplier.

A credit note will need to be added manually, it cannot be added through the email-to-bill facility in Xero.

Entering a Supplier Credit Note

- From the Dashboard go to Business Tab

- Click on Bills to Pay

- Click on New Credit Note

- Add details including cost centre and job number if it relates to a job invoice. Save or Approve as appropriate.

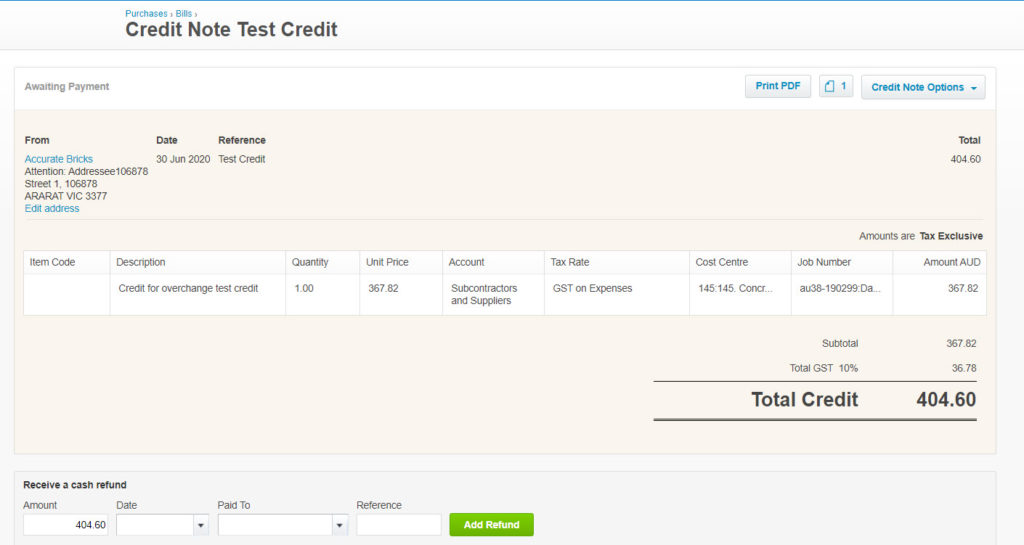

Allocation of Supplier Credit Note

- From the Dashboard go to the Business Tab.

- Click on Purchase Overview.

- Click on awaiting payment or use the search button to locate credit note.

- Click on the credit note to open.

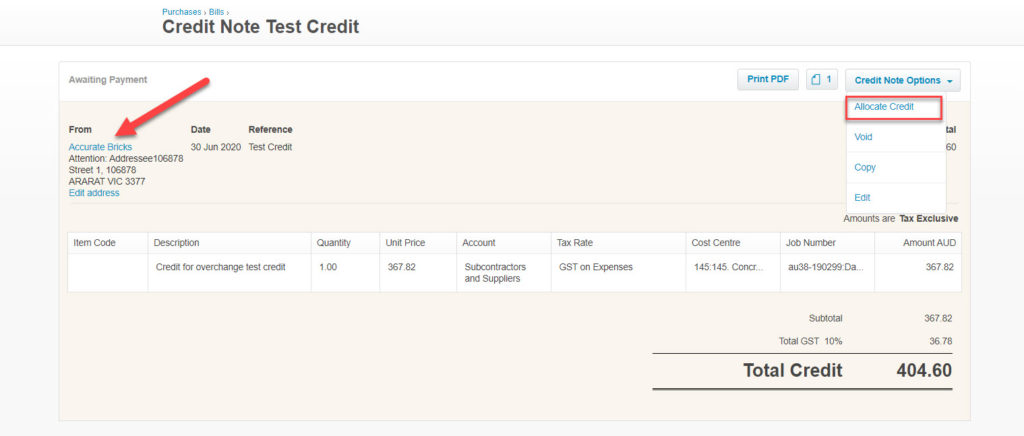

- In the right hand corner you will see Credit Note Options.

- Use the dropdown and choose Allocate Credit

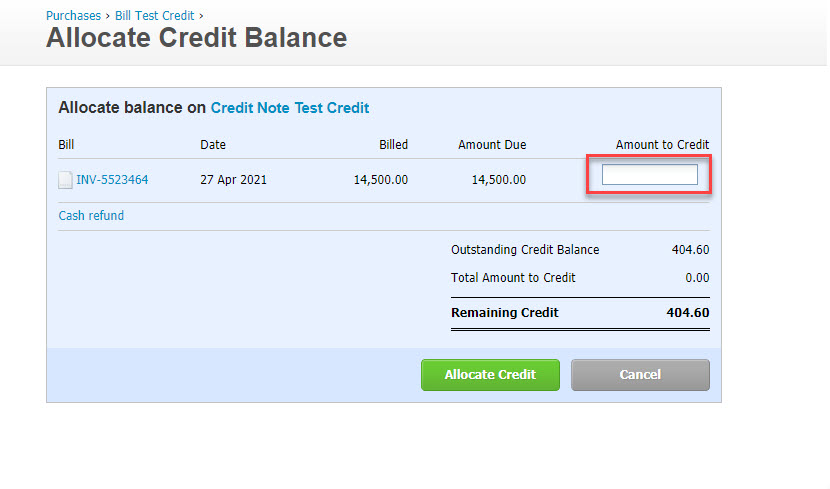

- Allocate credit amount to one or more invoices

- Click Allocate Credit

- The credit will show against the invoice it is allocated to.