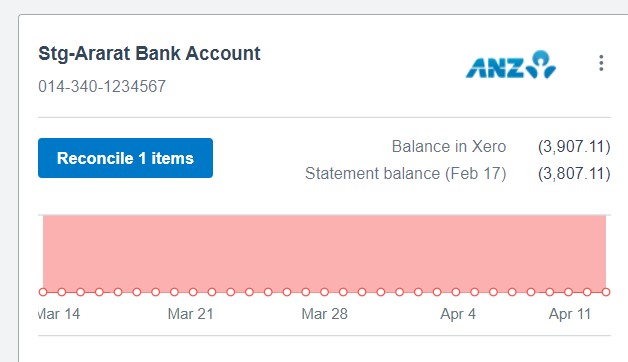

The bank account functionality and reconciliation in Xero is the heart of the financial data movement for the franchise.

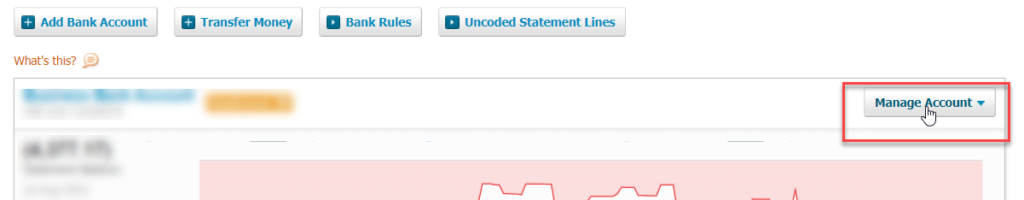

Manage Account

From the dashboard choose Accounting, then Bank accounts.

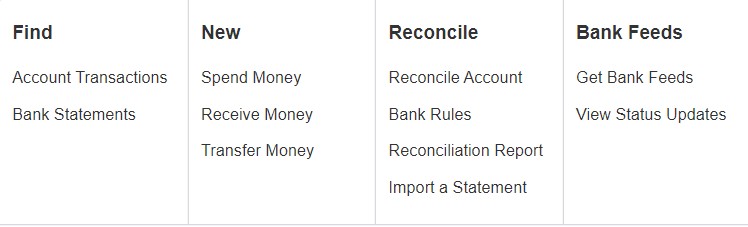

There are various functions within the bank account management menu:

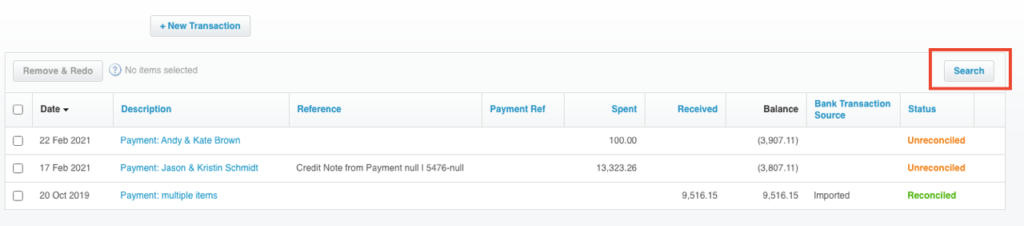

Account Transactions

Account Transactions show all transactions within the bank account, whether reconciled or not. The search button allows you to search for any transaction using various fields.

You can also access the Account Transactions from the reconcile screen.

Bank Statements

Bank Statements are fed in when you link up the bank feeds. The statement lines come through on each import and occur overnight on each business day. You match statement lines with Account Transaction lines during the bank reconciliation.

Spend Money

Spend money is for creating a transaction where you are spending money – generally Spend money transactions are coded from the bank reconciliation screen under Create Transaction. However, if you want to create a transaction before the bank feed and subsequent reconciliation occurs, you can create a spend money transaction.

This is only for those transactions outside of job costs, supplier and overhead invoices. For example

- Bank fees

- Hire purchase

- Loan

- Small one-off spends

Receive Money

Receive money is for creating a transaction where you are receiving money – generally Receive money transactions are coded from the bank reconciliation screen under the create tab. However, if you want to create a transaction before the bank feed and subsequent reconciliation occurs, you can create a receive money transaction. This is only for those transactions not attached to an existing progress or variation claim.

For Example

- Bank interest

- Shareholder loan

- Transactions that don’t require an invoice to be issued for them

Transfer Money

Transfer money is for creating a transaction where you are transferring money between Xero-recognized bank accounts – generally transfer money transactions are coded from the bank reconciliation screen. However, if you want to create a transaction before the bank feed and subsequent reconciliation occurs, you can create a transfer money transaction.

Bank Reconciliation

A bank reconciliation is a task that indicates the true balance of your bank account and identifies any transactions that are causing a difference between your bank account balance and the balance in your transaction listings and subsequent balance. A bank reconciliation ensures all transactions have been accounted for.

This is where all of the bank reconciliation is done. The bank statement lines feed in on the left hand side and the transaction to either match, create, transfer or discuss are on the right side. Matches, suggestions and rules are all actioned in this area. See Xero Help for more information.

Bank Rules

A Bank Rule is a set of instructions to filter a transaction that comes through on a bank feed in your Xero company file. You create a set of parameters that dictate who the contact is for the transaction, where and how it should be coded, and what bank account the rule applies to.

For further details on how to set up a bank rule please visit Xero – Bank Rules.

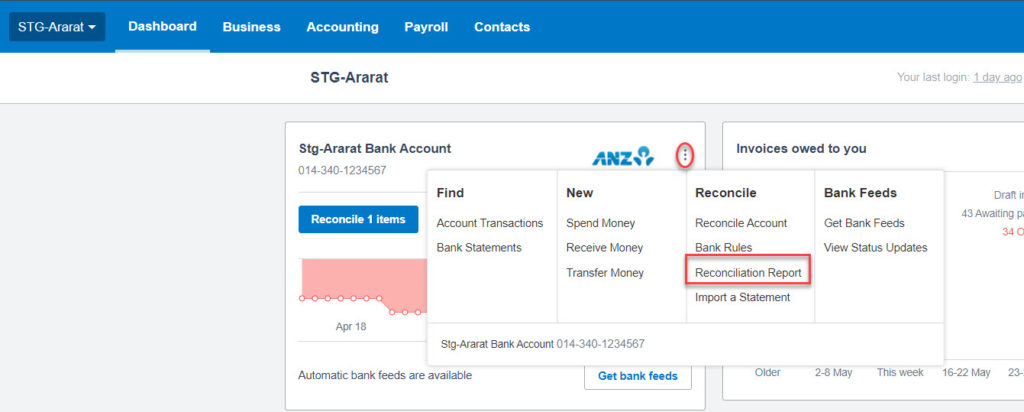

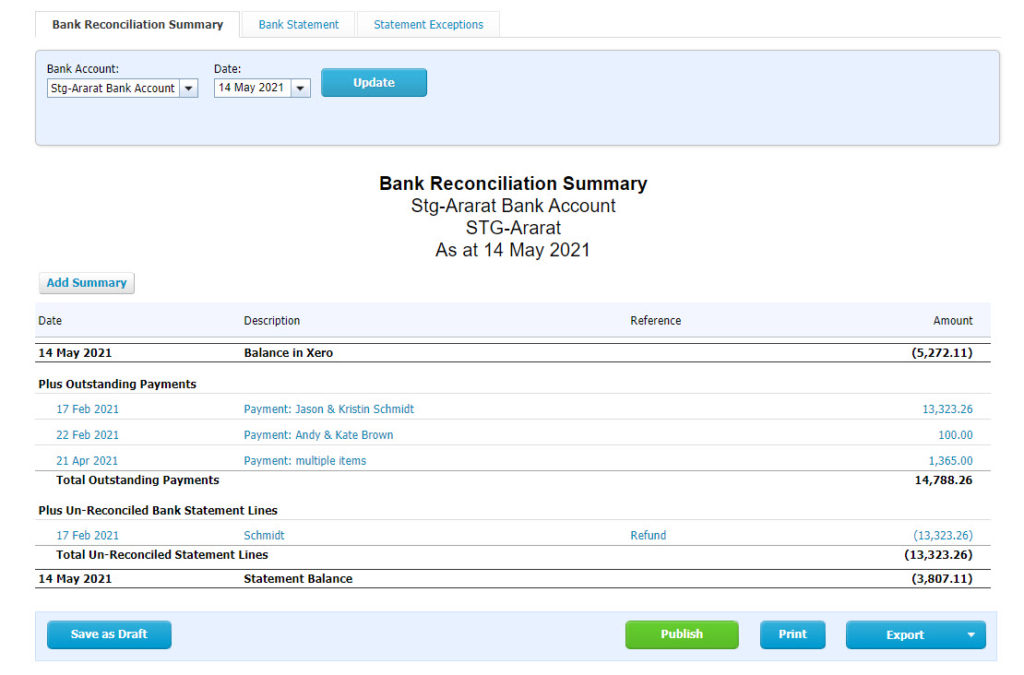

Bank Reconciliation Report

To produce a bank reconciliation report;

- Click Overflow Menu

- Click Reconciliation Report

- Select Bank Account or Credit Card to Reconcile

- Add the date of the report

- Click Update

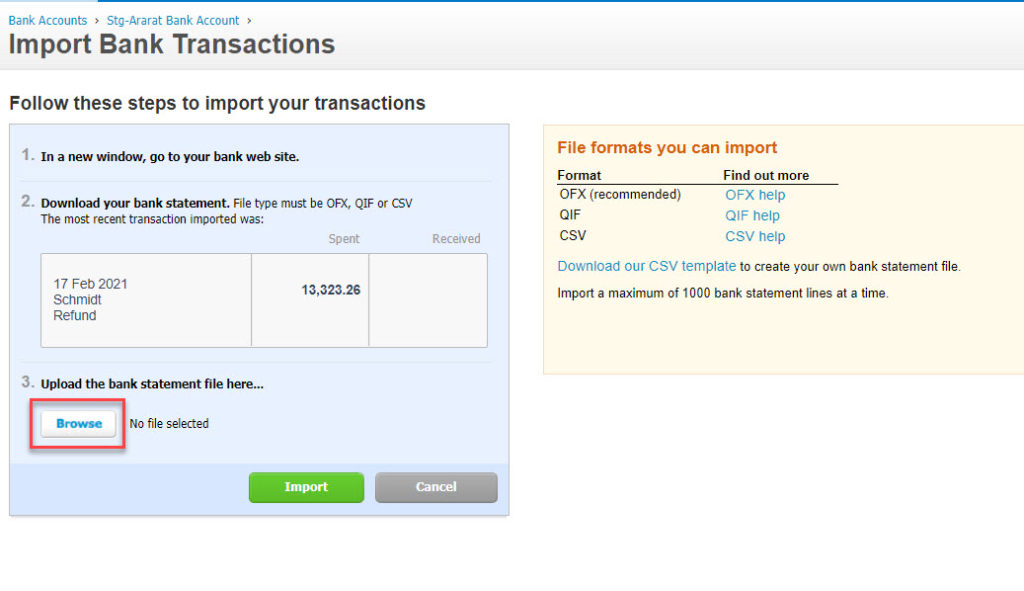

Importing a Bank Statement

There are times when you need to bring in bank statement lines to your bank feed, generally this is required before you bank feed starts or if there is a gap with the bank transactions due to a bank feed disruption.

- Click Overflow menu

- Click Import Bank Transactions

- Click on Browse

- Select saved OFX, QIF or CSV file generated from your bank

- Click Import