The Job Profit report provides an analysis of profit for finalized and non-finalized Jobs, as follows:

- When you generate the report on finalized Jobs, the system samples all Jobs which Finalized Data falls within the selected reporting period. The generated report allows to evaluate the profit which you planned to make (Forecast Profit) and the profit which you actually made (Gross Profit).

- When you generate the report on non-finalized Jobs, the system samples all non-finalized Jobs. It allows you to examine the profit which you planned to make (Forecast Profit) and the profit which can be allocated to date based on the completion percentage.

- Open the library with reports.

- Select Job Profit.

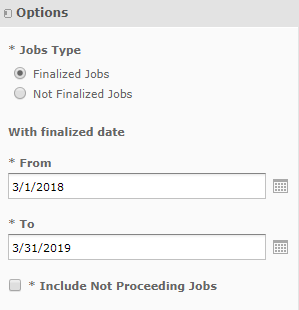

- Define criteria for generating the report, as follows:

Criteria

Jobs Type Select the Job type which you want to generate the report on, as follows: Finalized Jobs Not Finalized Jobs With finalized date from … to … Select the date range for including the Finalized Jobs with the Finalize Date within this range. This criterion is not available if you generate the report on non-finalized Jobs. Include Not Proceeding Jobs Check the box to include Jobs in the Not Proceeding state into the report.

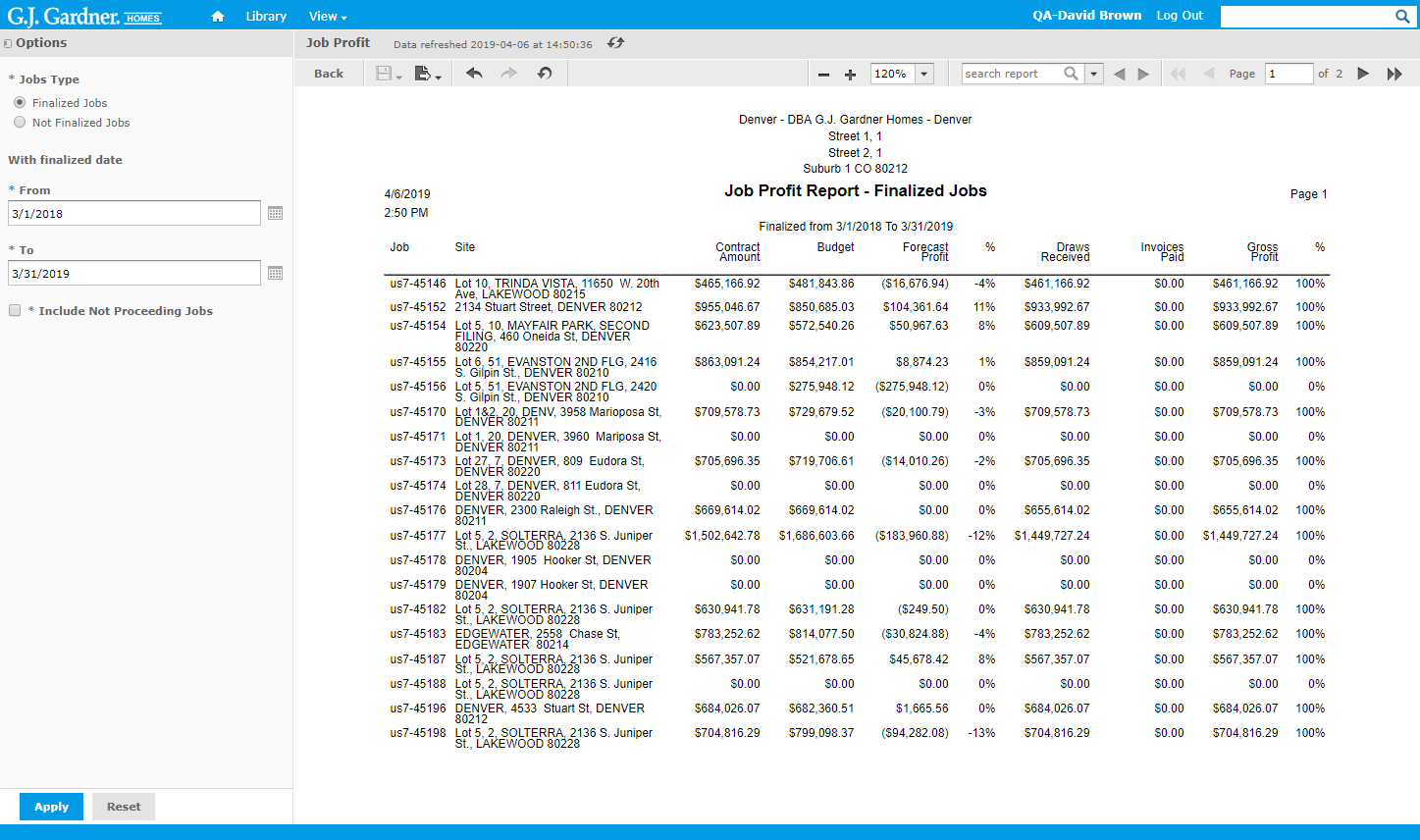

3. When complete, click Apply. The report is generated, as follows:

The report shows the following information about finalized Jobs:

Report Information – Finalized Jobs

| Job | Job number including the Office’s number as prefix. |

| Site | Site where the Job is performed. |

| Contract Amount | Contract amount of the Job. |

| Budget | Estimated cost of the Job. |

| Forecast Profit | Forecast profit of the Job. It is calculated as subtraction of the Job budget from the contract amount.

The forecast profit is placed into square brackets when the budget is less than the contract amount. |

| % | Forecast Profit percentage. It is calculated as the ratio of the forecast profit to contract amount. The value can be negative. |

| Draws Received | Draw amounts received for the Job. |

| Invoices Paid | Invoice amounts that were paid for the Job. |

| Gross Profit | Gross profit of the Job. It is calculated as subtraction of the Invoice Paid amount from the Draw Received amount. |

| % | Gross profit percentage for the Job. It is calculated as ratio of Invoices Paid amount to the Job Budget. |

The report shows the following information about non-finalized Jobs:

Report Information- Non-Finalized Jobs

| Job | Job number including the Office’s number as prefix. |

| Site | Site where the Job is performed. |

| Contract Amount | Contract amount of the Job. |

| Budget | Estimated cost of the Job. |

| Forecast Profit | Forecast profit of the Job. It is calculated as subtraction of the Job budget from the contract amount.

The forecast profit is placed into square brackets when the budget is less than the contract amount. |

| % | Forecast Profit percentage. It is calculated as the ratio of the forecast profit to contract amount. The value can be negative. |

| Invoices Paid | Invoice amounts that were paid for the Job. |

| $ Budget Complete | Budget completion percentage for the Job. It is calculated as ratio of Invoices Paid amount to the Job Budget. |

| Profit Allocated | Profit allocated for the non-finalized Job. It is calculated as ratio of multiplied Forecast Profit and Invoiced Paid amounts to the Job Budget. |